Author Archive

Special Edition Tortelicious: Tracking Rebecca Thybulle (Jury Duty Idiot)

November 9th, 2010. By admin

It’s a two-for-Tuesday today at Totally Tortelicious. Some stories are really just too precious not to share—and this baby deserves her very own Tortelicious…

It’s a two-for-Tuesday today at Totally Tortelicious. Some stories are really just too precious not to share—and this baby deserves her very own Tortelicious…

[Note, as you read on, I have another “two” for you—two words: Background Check. Just tuck those away for now…]

So here’s Rebecca Thybulle. She’s an HR Manager in Staten Island, NY—and she’s been a Payroll Manager according to several reports, as well as her LinkedIn profile. That’s right—a Payroll Manager—you know, one of those people who figures out who’s been working when and how much they should be getting paid every two weeks and all. She should know a thing or two about “paid time off“, right? (Not to mention that you’d hope she had a bit of integrity when it came to a company’s purse strings…but I’m ahead of myself.)

Well, she may know about it, but she apparently doesn’t feel the need to play by the paid-time-off rule book herself. First, her latest news…

It seems Rebecca wanted to take some time off from work. Several days’ worth. Clearly, no one would want to blow vacation days on that. And to feign illness and call in sick would only work for a day or two…hard to milk a week or so outta that one—and then you risk that whole short term disability thing, too. No that won’t work. So what else does a red-blooded American have in her paid-time-off (aka PTO) toolbelt to skip out of work for several days and still get paid for it? Hmm…

Well, there’s the death-in-the-family route, but that would probably risk a few do-gooders at work trying to offer their condolences and wondering where to send flowers… Nah…that won’t cut it.

Oh! There’s jury duty! Oh—but wait—you need one of those you’ve-been-summoned-to-jury-duty mailer thing-a-ma-jigs to submit to your HR department. That’s the usual policy at least. And, how fortuitous! How seemingly serendipitous! It appears that Rebecca—or at least someone in her household—had received a jury duty notice! Lucky, lucky Rebecca!

Only thing was, it was apparently for her dad.

No biggie. She allegedly just forged the notice to say it was hers, handed it in at work, and…voila!…she’s a free bird!

But, foolish, foolish Rebecca did not cover her tracks. She—one hopes in her haste vs her stupidity—left the original jury duty notice—the undoctored one—on her desk! Bad move Rebecca! Bad move!

It gets better: she decided to share her jailbreak news on Facebook—and told her best buds that she was “Bmore bound!” and en route to see a Kevin Hart show.

Long story short, she got nabbed bigtime…held in lieu of $25,000 bond and is now facing potentially up to 14 years in prison. Ouch!

Ok, but remember when I said to tuck those two words—background check—away? Well, here’s where they come into play. See, Rebecca is apparently not a “first time offender” as they say. Here’s her recent rap sheet. She is due for sentencing this month on a grand larceny charge. What did she do? Theft of about $6,400 from Coffee Shop (the Union Square eatery) where she had worked as a Payroll Manager.

Huh? And…

Ms. Thybulle was also previously convicted in 2002 for embezzling about $28,000 from an elderly home in Poughkeepsie, NY where she had worked…in charge of payroll.

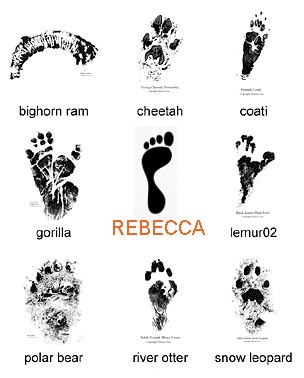

Ok—I can’t condone what Rebecca has done. Worse, she clearly sucks at it—she’s three for three on getting caught—not on getting away—and let’s just say that when performance review time comes around, well, Rebecca will be getting a “Needs Improvement” on a couple of things. Seriously, if Rebecca were part of the animal kingdom, predators wouldn’t have to work too hard—it’d be like, “oh look, yep, there’s Rebecca’s paw prints—she went thataway”.

But where the hell are the hiring managers who put her on payroll—and put her IN CHARGE of it—to begin with? Have they not heard of doing background checks? And heck, we’ve established that Rebecca’s not that good at covering her tracks so how hard could it be to uncover her rap sheet?

And people wonder why we have things like elder abuse, consumer fraud, malpractice…and on and on…

Great Tips to Avoid Being a Fraud Victim

November 1st, 2010. By admin

The US Postal Inspection Service (USPIS) is sending out flyers with some great tips on how to avoid becoming a victim of mail fraud—a type of consumer fraud. For those of you who may not have received it, I’ve shared some of the tips below.

The video above is from the USPIS website, deliveringtrust.com, where you can find further information about fraud—specifically cross-border fraud which is happening more frequently. It is a longer video—12 minutes—but there are some good tips at the end, and quite frankly, the USPIS did a pretty good job of channeling some sort of CSI episode to make the subject matter here more entertaining (if it’s possible to even make fraud “entertaining”).

You’ll also find a quiz over at deliveringtrust.com to test your scam radar savvy, and also information about fake checks, cross-border fraud, internet fraud, foreign lottery scams, work-at-home scams, identity theft, telemarketing fraud, and what to do if you’re a victim of fraud. Of course it’s a good idea to contact a consumer fraud attorney if you’ve been a fraud victim as well.

Warning Signs that may indicate a scam:

1. It sounds too good to be true.

2. You’re being pressured to act “right away”.

3. It guarantees success.

4. It promises unusually high returns.

5. It requires an upfront investment—even for a “free” prize.

6. It doesn’t have the look of a real business.

7. Something about it just doesn’t feel right.

Asbestos Corporate Bankruptcies: Don’t Shed A Tear

April 29th, 2010. By admin

Guest blogger, RJ Abernathy, is an Asbestos attorney with Goldenberg Heller Antognoli and Rowland. He has a unique perspective as an asbestos lawyer, having been a Laborer with Local 100 in East St. Louis, Illinois for over 20 years prior to becoming an attorney. As a Laborer, he worked in many of the same conditions as those in which his clients have worked. Abernathy also lost his own father to asbestos-related cancer in 1999.

Guest blogger, RJ Abernathy, is an Asbestos attorney with Goldenberg Heller Antognoli and Rowland. He has a unique perspective as an asbestos lawyer, having been a Laborer with Local 100 in East St. Louis, Illinois for over 20 years prior to becoming an attorney. As a Laborer, he worked in many of the same conditions as those in which his clients have worked. Abernathy also lost his own father to asbestos-related cancer in 1999.

A recent article published by an arm of the US Chamber of Commerce noted that another company “collapsed” under the weight of asbestos claims. According to this article, 89 such companies have “collapsed” since 1982. In the latest case, Durabla Manufacturing sold asbestos containing products well into the 1980’s, long after asbestos was recognized as a dangerous and deadly material.

A closer look at the other 88 “collapsed” companies reveals that not only have many of these companies remained in business, but many of them thrived after ‘going bankrupt.’ Walk into any Home Depot or Lowe’s home improvement stores and you will find a large percentage of these “collapsed” companies’ products on the shelves. For example, the Pink Panther didn’t lose his job when Owens Corning went bankrupt. Dick Cheney’s former employer, Halliburton, never missed a beat over the past seven years during the Iraq war since filing for bankruptcy protection due to its subsidiaries asbestos liabilities.

In another case, W.R. Grace filed for bankruptcy protection in 2001, even though it has annual sales of nearly 3 billion dollars. In 2005, the United States Department of Justice filed criminal charges against Grace, including counts for fraudulent transfers of nearly 5 billion dollars just prior to the bankruptcy filing.

In other cases, I think it is hard to argue that these companies should not have “collapsed.” The miners, manufacturers and purveyors of raw asbestos fibers should have been out of business Read the rest of this entry »

Ambulance Fat Fees coming to an EMS near you…

July 2nd, 2009. By admin

First it was the airlines—for which weight discrimination is still a hot topic of debate. But now, it seems American Medical Response (AMR) of Topeka, KS has been given clearance by the Shawnee County Commission to raise its fees for transporting overweight and critical care patients.

First it was the airlines—for which weight discrimination is still a hot topic of debate. But now, it seems American Medical Response (AMR) of Topeka, KS has been given clearance by the Shawnee County Commission to raise its fees for transporting overweight and critical care patients.

According to a June 30th article on ABC affiliate Nebraska.tv, AMR will now be able to increase what it charges for ambulance costs for critical care patients and overweight people from $629 to $1,172. It doesn’t take a math scholar to figure out that it’ll cost you almost double if you tip the scales at over 350 lbs (the threshold weight for the increase). Read the rest of this entry »

New study on MRI & Gadolinium…but does it matter?

July 1st, 2009. By admin

The June issue of the American Journal of Roentgenology (as reported by docguide.com) has the results of a new study on MRI health risks–particularly those associated with gadolinium contrast. According to the docguide.com article,

The June issue of the American Journal of Roentgenology (as reported by docguide.com) has the results of a new study on MRI health risks–particularly those associated with gadolinium contrast. According to the docguide.com article,

“Even at very high doses, gadolinium-based contrast agents alone are not sufficient to cause nephrogenic systemic fibrosis (NSF) in patients with kidney problems,…”

That’s a statement that caught my eye given all the prior studies on the risks of gadolinium as an MRI contrast agent and its connection to Nephrogenic Systemic Fibrosis (NSF).

In the study, led by Dr. Mellena D. Bridges, of the Mayo Clinic, Jacksonville, Florida, records of 61 patients who received high-dose IV gadodiamide for catheter angiography or computed tomography (CT) between January 2002 and December 2005 were examined. Read the rest of this entry »

Archive by Category

- Accidents (24)

- Airlines (9)

- Asbestos Mesothelioma (262)

- Automotive (25)

- Celebrity (14)

- Class Action (84)

- Complaints/Comments (15)

- Consumer Fraud (84)

- Contest (2)

- Court of Public Opinion (5)

- Crazy Sh*t Lawyers See (61)

- Criminal Law (4)

- Defective Products (111)

- DePuy ASR Hip Recall (2)

- Discrimination (22)

- Drugs/Medical (248)

- Elder Care Abuse (4)

- Emerging Issues (462)

- Employment (54)

- Environment (52)

- Financial (28)

- Food Illness (15)

- Human/Civil Rights (4)

- Insecurities (5)

- Insurance (16)

- Intellectual Property (16)

- Internet/E-commerce (19)

- lawsuits (161)

- Lawyers (20)

- Lawyers Giving Back (43)

- Lex Levity (10)

- Personal Injury (106)

- Pleading Ignorance (53)

- Real Estate (2)

- Recall (6)

- Scam (3)

- Securities (13)

- Settlement (81)

- Tort Reform (2)

- Totally Tortelicious (81)

- Veterans (11)

- Whistleblower (9)