It’s Unacceptable: Vets Face a Battle on the Homefront, too

November 11th, 2010. By Kristine B

With Veterans’ Day upon us, Pleading Ignorance takes a break from explaining legalese and takes the opportunity to thank veterans for all they have done—and all they have sacrificed. And we look at some of the battles veterans face when they return home, and ask why we can’t do more for the people who have sacrificed so much?

With Veterans’ Day upon us, Pleading Ignorance takes a break from explaining legalese and takes the opportunity to thank veterans for all they have done—and all they have sacrificed. And we look at some of the battles veterans face when they return home, and ask why we can’t do more for the people who have sacrificed so much?

Each year on Veterans’ Day, we take the time to pay tribute to those who have sacrificed so much—in some cases, their lives—in the service of their country. We take a moment to remember those who died and give our respect to veterans who so bravely fought, and continue to fight, so that many of us don’t have to.

I’d like to think that Veterans’ Day still means something, but some of the thank you’s might seem a bit hollow, considering the treatment that veterans return home to. After facing horrors that many of us can’t even conceive of, they come home to long and often complex claim s processes, face having their very real claims of post-traumatic stress disorder (PTSD) or traumatic brain injury (TBI) declined or questioned, and receive sometimes questionable medical treatment at the hands of Veterans Affairs medical centers and hospitals. They face medical malpractice and unreasonably denied disability claims.

s processes, face having their very real claims of post-traumatic stress disorder (PTSD) or traumatic brain injury (TBI) declined or questioned, and receive sometimes questionable medical treatment at the hands of Veterans Affairs medical centers and hospitals. They face medical malpractice and unreasonably denied disability claims.

It’s unacceptable.

Back in 2007, veterans spoke before Congress about horrific conditions at Walter Reed Army Medical Center. Those conditions included one sergeant being released to outpatient treatment within a week of being shot in the head, despite having a TBI and having lost an eye. The same sergeant faced delayed treatment because of lost documents and ultimately had to take his medical care into his own hands because no one from continuing care would contact him.

At the time, acting secretary of the Army, Pete Geren, stated, “We have let some soldiers down,” (as quoted in The New York Times (3/6/2007).

It’s unacceptable.

These are people who have given up so much for their country—they deserve more than to be “let down”. They deserve the best possible medical care, not weeks and months of waiting for Read the rest of this entry »

Chinese Drywall: Now Finger’s Pointing at Banks

November 10th, 2010. By LucyC

Well, it seems like the perfect storm has arrived on the doorsteps of American banks. For quite some time the pressure has been building around banking practices, specifically due diligence on foreclosures, which has recently resulted in a rash of class action lawsuits in various states across the country (see above chart for the breakdown of Chinese drywall reported incidents by state), as well as investigations by Attorneys General in several states. And there will likely be more to come. Now, in a bizarre twist of fate, it seems the Chinese drywall debacle has been added to the foreclosure mess. And what a witches brew it is.

This week, the Chinese Drywall Complaint Center (CDCC)—a national watchdog group—has issued a press release stating that “we are now targeting greedy US banks, for reselling toxic Chinese drywall foreclosures in Florida, and other US States, without an oh by the way—anytime after February of 2009.” They go on to state that “by March of 2009 we do not think there was a single US bank, or loan servicer that was unaware of the toxic Chinese drywall disaster—yet they continued to sell their poisonous foreclosures AS IS—no disclosure of this toxic Chinese drywall product to unsuspecting US consumers?” And, “For clarification purposes the Chinese Drywall Complaint Center is saying, “contrary to homebuilder claims about only using toxic Chinese drywall after Hurricane Katrina in August of 2005—toxic Chinese drywall has been used in Florida since as early as 2001.”

According to the CDCC website, the organization has “now determined with 100% certainty, that imported toxic Chinese drywall has been installed all over the US Southeast including the states of Florida, Louisiana, Virginia, Mississippi, Alabama, Southeast Texas, Virginia, Georgia, and South Carolina. Tragically, we believe toxic Chinese drywall has also been installed in all other regions of the United States. However, without high thresholds of heat & humidity, it becomes much more difficult to see the worst effects of toxic Chinese drywall.”

And, they also state that “many homes in the US Southeast have toxic Chinese drywall intermixed with US made drywall. If these homes were built or remodeled after 2001, we believe a small amount of imported Chinese drywall is enough to make an entire house toxic. The net result is [that] instead of ending up with tens of thousands of now toxic US Southeast homes, we are convinced we have 100,000’s of toxic US Southeast homes.”

It’s highly likely that people have purchased foreclosures that contain Chinese drywall. Thinking about who might be liable, though, actually makes my head spin: purchasers need due diligence such as home inspections; and lenders like to make sure the property is in good nick before they finance the mortgage; but then if it’s a foreclosure, wouldn’t the bank selling the house have to disclose that it was contaminated with Chinese drywall—provided they knew? And for that matter, does anyone have to disclose that a house is contaminated with Chinese drywall? These and many more questions come to mind. For my money, finding the answers would definitely be best left to lawyers.

But—deep in the midst of the Chinese Drywall hurricane there is some good news. Recently, Chinese drywall manufacturer Knauf Plasterboard Tianjin Company agreed to pay to repair 300 homes in Florida, Louisiana, Alabama and Mississippi in a pilot remediation program. Reportedly, a Louisiana-based supplier and several home builders and insurers are contributing to the cost of the repairs. More than 3,000 claims are supposedly pending against Knauf. Let’s hope it goes well, because if it does the program might provide a framework for a larger settlement, which no doubt would be welcome.

Special Edition Tortelicious: Tracking Rebecca Thybulle (Jury Duty Idiot)

November 9th, 2010. By admin

It’s a two-for-Tuesday today at Totally Tortelicious. Some stories are really just too precious not to share—and this baby deserves her very own Tortelicious…

It’s a two-for-Tuesday today at Totally Tortelicious. Some stories are really just too precious not to share—and this baby deserves her very own Tortelicious…

[Note, as you read on, I have another “two” for you—two words: Background Check. Just tuck those away for now…]

So here’s Rebecca Thybulle. She’s an HR Manager in Staten Island, NY—and she’s been a Payroll Manager according to several reports, as well as her LinkedIn profile. That’s right—a Payroll Manager—you know, one of those people who figures out who’s been working when and how much they should be getting paid every two weeks and all. She should know a thing or two about “paid time off“, right? (Not to mention that you’d hope she had a bit of integrity when it came to a company’s purse strings…but I’m ahead of myself.)

Well, she may know about it, but she apparently doesn’t feel the need to play by the paid-time-off rule book herself. First, her latest news…

It seems Rebecca wanted to take some time off from work. Several days’ worth. Clearly, no one would want to blow vacation days on that. And to feign illness and call in sick would only work for a day or two…hard to milk a week or so outta that one—and then you risk that whole short term disability thing, too. No that won’t work. So what else does a red-blooded American have in her paid-time-off (aka PTO) toolbelt to skip out of work for several days and still get paid for it? Hmm…

Well, there’s the death-in-the-family route, but that would probably risk a few do-gooders at work trying to offer their condolences and wondering where to send flowers… Nah…that won’t cut it.

Oh! There’s jury duty! Oh—but wait—you need one of those you’ve-been-summoned-to-jury-duty mailer thing-a-ma-jigs to submit to your HR department. That’s the usual policy at least. And, how fortuitous! How seemingly serendipitous! It appears that Rebecca—or at least someone in her household—had received a jury duty notice! Lucky, lucky Rebecca!

Only thing was, it was apparently for her dad.

No biggie. She allegedly just forged the notice to say it was hers, handed it in at work, and…voila!…she’s a free bird!

But, foolish, foolish Rebecca did not cover her tracks. She—one hopes in her haste vs her stupidity—left the original jury duty notice—the undoctored one—on her desk! Bad move Rebecca! Bad move!

It gets better: she decided to share her jailbreak news on Facebook—and told her best buds that she was “Bmore bound!” and en route to see a Kevin Hart show.

Long story short, she got nabbed bigtime…held in lieu of $25,000 bond and is now facing potentially up to 14 years in prison. Ouch!

Ok, but remember when I said to tuck those two words—background check—away? Well, here’s where they come into play. See, Rebecca is apparently not a “first time offender” as they say. Here’s her recent rap sheet. She is due for sentencing this month on a grand larceny charge. What did she do? Theft of about $6,400 from Coffee Shop (the Union Square eatery) where she had worked as a Payroll Manager.

Huh? And…

Ms. Thybulle was also previously convicted in 2002 for embezzling about $28,000 from an elderly home in Poughkeepsie, NY where she had worked…in charge of payroll.

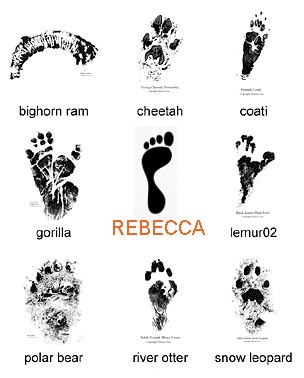

Ok—I can’t condone what Rebecca has done. Worse, she clearly sucks at it—she’s three for three on getting caught—not on getting away—and let’s just say that when performance review time comes around, well, Rebecca will be getting a “Needs Improvement” on a couple of things. Seriously, if Rebecca were part of the animal kingdom, predators wouldn’t have to work too hard—it’d be like, “oh look, yep, there’s Rebecca’s paw prints—she went thataway”.

But where the hell are the hiring managers who put her on payroll—and put her IN CHARGE of it—to begin with? Have they not heard of doing background checks? And heck, we’ve established that Rebecca’s not that good at covering her tracks so how hard could it be to uncover her rap sheet?

And people wonder why we have things like elder abuse, consumer fraud, malpractice…and on and on…

Call of Duty Black Ops Wannabes Keeping it (too) Real

November 9th, 2010. By LucyC

Life imitating art—or art imitating life? Or is it something a little more sinister. Clearly these guys haven’t mastered that fine line between fantasy and reality… At least two men staged a rather dramatic robbery of a Maryland video-game store during the weekend. The haul? More than 100 copies of a highly valued video game that hasn’t yet hit the market, according to local police.

Life imitating art—or art imitating life? Or is it something a little more sinister. Clearly these guys haven’t mastered that fine line between fantasy and reality… At least two men staged a rather dramatic robbery of a Maryland video-game store during the weekend. The haul? More than 100 copies of a highly valued video game that hasn’t yet hit the market, according to local police.

The men entered the GameStop video store in the Festival at Bel Air shopping center just as it was closing (note to self—don’t go renting games and videos at the end of the day). The dudes in black were armed with semiautomatic weapons. They stole four cases of “Black Ops,” the newest game in the “Call o f Duty” series, along with cash and other games.

f Duty” series, along with cash and other games.

According to the Harford County Sherriff’s office, this is the second armed robbery of a Harford County GameStop within three weeks, and it’s possible the same bad guys are responsible for the initial robbery on October 21 at GameStop’s Aberdeen location.

In addition to the staff, two would-be customers also experienced the first-hand adrenalin rush of being held at gunpoint— as they had the misfortune to come into the store as it was being robbed. They were escorted into a storage area. No one was hurt.

The game, which is due for release today (yes, TODAY!), October 9, is rated “mature” for intense violence, strong language and “blood and gore.” I wonder how far these guys were prepared to go with their own black-ops?

Well, he didn’t walk the line, but maybe he crossed it a bit… but I think he gets straight A’s for having his sense of humor and creativity. A teen from Nebraska was arrested for DWI on Halloween—while dressed as a Breathalyzer—that’s him over there at the right. That in itself indicates some skill with duct tape…which I also think is worthy of mention.

Demonstrating his creative flare, Matthew Nieveen’s costume consisted of a box-like plastic sack that read “6.0 Blood Alcohol Level.” And, if anyone wanted to test their own limits, he had included a nozzle strategically placed in a ‘sensitive area’ which read “Blow Here.”

I bet Matthew could sell a few of those costumes…

Time to bug outta here? As for this dear old boy—he didn’t actually get himself arrested, but I think he likely came pretty close. A team of emergency responders was called out to a senior citizens’ high-rise residence in response to reports of intense fumes coming from a second-floor room. Just to be clear, we’re talking about firefighters and hazardous materials specialists—you know—guys in white paper suits and plastic helmet hats that are way out of proportion to the rest of the outfit…anyway…

The emergency crews arrived and were so bowled over by the intensity of the fumes that they evacuated the entire second floor—late in the evening. Always fun, those late night fire alarms. Once the fuss had died down and people were outside shivering in their PJs, the firefighters located the source of the problem—which was—insect foggers. A resident had decided to take pest control into his own hands and set off several of the devices in his apartment. This in turn caused the smoke alarms to go off. Oh—I’m betting that this little caper cost him his bridge partners at a minimum. And what’s the betting the bugs survived. Maybe the video game store should have some of these devices on hand…

The Meridia Conspiracy Theory?

November 5th, 2010. By janem

If I were a conspiracy theorist, I’d say the FDA and Abbott Labs, the maker of Meridia, are in cahoots together. If that were the case, it would explain away the reason why the FDA approved the diet-suppressant drug soon after it declared Fen-Phen—an older cousin—unsafe, back in 1997. It would also explain how Abbott was able to market Meridia just two months after Fen-Phen was taken off the market.

Stay with me here… imagine the FDA getting kickbacks from drug companies for keeping their dangerous drugs on the market (Meridia lived for 14 years and that rings cha-ching). I’ll go out on a limb and take this one step further: Fen-Phen was typically taken by obese people for weight loss, and obese people often wind up with diabetes. Still here? Good. Diabetes is the biggest economic drain on the health system so wouldn’t it be easier just to kill obese people via heart attacks and strokes with drugs like Meridia and Fen-Phen before they become diabetic and a drain to the economy?

Here are the facts on diabetes: The American Journal of Public Health said that diabetes is a monumental drain on US Resources. The US has the largest number of diabetics (16 million) of all the developed countries and people with diabetes were responsible for 23 percent of US hospitals’ expenses in treating all conditions in 2008.

said that diabetes is a monumental drain on US Resources. The US has the largest number of diabetics (16 million) of all the developed countries and people with diabetes were responsible for 23 percent of US hospitals’ expenses in treating all conditions in 2008.

Although diabetes sufferers compose 8 percent of the US population, by 2008 they were responsible for 20 percent of US hospitalizations. It gets worse: those diabetes patients stayed longer in the hospital—5.3 days on average, as compared to 4.4 days for people without diabetes—and cost more—$10,937 on average, compared to $8,746. And we all know that when it comes to hospitalization, well, there’s no would-be money in that for the FDA–the money would be in prescription drugs.

OK, I’m getting carried away with the conspiracy theory. And in truth, if there were a conspiracy, hey, diabetics would surely be a necessary gravy train for potential kick-backs to the FDA—one need only look to the FDA’s handling of Avandia.

But really, what planet are you living on if you think that Meridia is safe? Or that it even works? Read the rest of this entry »

Archive by Category

- Accidents (24)

- Airlines (9)

- Asbestos Mesothelioma (262)

- Automotive (25)

- Celebrity (14)

- Class Action (84)

- Complaints/Comments (15)

- Consumer Fraud (84)

- Contest (2)

- Court of Public Opinion (5)

- Crazy Sh*t Lawyers See (61)

- Criminal Law (4)

- Defective Products (111)

- DePuy ASR Hip Recall (2)

- Discrimination (22)

- Drugs/Medical (248)

- Elder Care Abuse (4)

- Emerging Issues (462)

- Employment (54)

- Environment (52)

- Financial (28)

- Food Illness (15)

- Human/Civil Rights (4)

- Insecurities (5)

- Insurance (16)

- Intellectual Property (16)

- Internet/E-commerce (19)

- lawsuits (161)

- Lawyers (20)

- Lawyers Giving Back (43)

- Lex Levity (10)

- Personal Injury (106)

- Pleading Ignorance (53)

- Real Estate (2)

- Recall (6)

- Scam (3)

- Securities (13)

- Settlement (81)

- Tort Reform (2)

- Totally Tortelicious (81)

- Veterans (11)

- Whistleblower (9)